Mcgraw hill connect accounting answers chapter 1 – Embark on a comprehensive journey through the intricacies of accounting with McGraw-Hill Connect Accounting Answers Chapter 1. This meticulously crafted guide unveils the fundamental concepts, principles, and practices that underpin the language of business.

Delve into the essential elements of accounting, including its purpose, types of transactions, and the double-entry system. Discover the significance of financial statements and explore the interconnectedness of the balance sheet, income statement, and statement of cash flows.

Chapter Overview

Chapter 1 of McGraw-Hill Connect Accounting provides a comprehensive introduction to the fundamental concepts of accounting. It covers the basic principles, terminology, and processes used in the accounting profession.

The main learning objectives of this chapter are to:

- Understand the purpose and importance of accounting.

- Learn the different types of accounting transactions.

- Explain the double-entry accounting system.

- Identify and understand the three main financial statements.

- Describe the steps involved in the accounting cycle.

- Account for assets, liabilities, and owner’s equity.

Accounting Basics

Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful for decision-making. The purpose of accounting is to provide financial information about an organization to external users, such as investors and creditors, and to internal users, such as management.

There are three main types of accounting transactions: assets, liabilities, and owner’s equity. Assets are resources owned by a company, such as cash, inventory, and equipment. Liabilities are debts owed by a company, such as accounts payable and notes payable.

Owner’s equity is the residual interest in the assets of a company after deducting its liabilities.

The double-entry accounting system is a method of recording transactions that ensures that the total debits equal the total credits. In the double-entry accounting system, each transaction is recorded in at least two accounts, with one account being debited and the other account being credited.

Financial Statements, Mcgraw hill connect accounting answers chapter 1

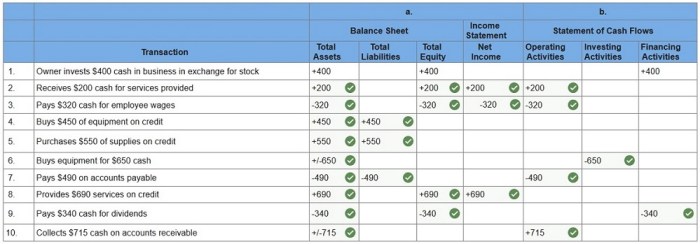

The three main financial statements are the balance sheet, the income statement, and the statement of cash flows. The balance sheet provides a snapshot of a company’s financial position at a specific point in time. The income statement shows a company’s financial performance over a period of time.

The statement of cash flows shows a company’s cash inflows and outflows over a period of time.

The balance sheet has three main sections: assets, liabilities, and owner’s equity. The income statement has three main sections: revenues, expenses, and net income. The statement of cash flows has three main sections: operating activities, investing activities, and financing activities.

The financial statements are interrelated. The balance sheet provides the starting point for the income statement, and the income statement provides the starting point for the statement of cash flows.

The Accounting Cycle

The accounting cycle is the process of recording, classifying, and summarizing financial transactions and preparing financial statements. The accounting cycle consists of the following steps:

- Recording transactions in a journal.

- Posting journal entries to the ledger.

- Preparing a trial balance.

- Adjusting the trial balance.

- Preparing financial statements.

- Closing the books.

The accounting cycle is a continuous process that repeats itself each accounting period.

Accounting for Assets

Assets are resources owned by a company. Assets are classified into two main types: current assets and non-current assets. Current assets are assets that can be easily converted into cash, such as cash, inventory, and accounts receivable. Non-current assets are assets that cannot be easily converted into cash, such as land, buildings, and equipment.

The accounting treatment for acquiring, using, and disposing of assets depends on the type of asset.

Accounting for Liabilities

Liabilities are debts owed by a company. Liabilities are classified into two main types: current liabilities and non-current liabilities. Current liabilities are debts that are due within one year, such as accounts payable and notes payable. Non-current liabilities are debts that are due more than one year from now, such as bonds payable and mortgages.

The accounting treatment for incurring, paying, and settling liabilities depends on the type of liability.

Accounting for Owner’s Equity

Owner’s equity is the residual interest in the assets of a company after deducting its liabilities. Owner’s equity is divided into two main types: contributed capital and retained earnings. Contributed capital is the amount of money that the owners have invested in the company.

Retained earnings are the earnings that have been reinvested in the company.

The accounting treatment for transactions affecting owner’s equity depends on the type of transaction.

Popular Questions: Mcgraw Hill Connect Accounting Answers Chapter 1

What is the purpose of accounting?

Accounting provides a systematic way to record, classify, summarize, and interpret financial transactions to provide information that is useful for decision-making.

What are the different types of accounting transactions?

Accounting transactions are classified into four main types: revenue, expense, asset, and liability.

What is the double-entry accounting system?

The double-entry accounting system is a method of recording transactions that ensures that every transaction has an equal debit and credit entry, resulting in a balanced equation.